Solana price is currently struggling near $200, and here are some of the major catalysts for a move toward $250.

The price of Solana has been locked around the $200 level. The cryptocurrency has struggled to hold gains despite the general market’s rally.

Over the past six weeks, SOL has repeatedly tested this zone but has failed to secure any strength above it. Meanwhile, competitors like Ether and BNB have reached new highs, leaving investors to wonder what is slowing Solana’s advance.

Futures and Derivatives Show Balanced Demand

One major issue is the lack of strong bullish leverage in the derivatives markets. Data from laevitas.ch shows that perpetual futures premiums for SOL sit around 10%. This is a neutral level because normally, healthy demand keeps this rate between 8% and 14%.

While current readings are not negative, the figure isn’t positive either, and shows little appetite for aggressive long positions.

Binance’s top-trader long-to-short ratio also turned more bearish lately. Particularly bullish positioning has faded after reaching a monthly high last weekend. This indicates that whales and market makers are waiting for clearer signs before backing a breakout above $200.

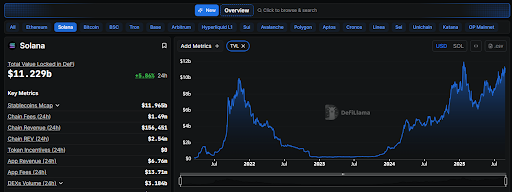

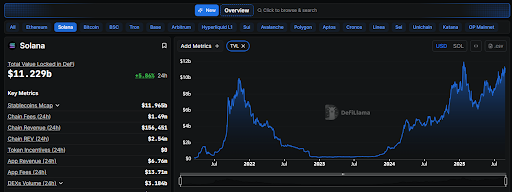

Weak On-Chain Data Creates Uncertainty

Another of the biggest hindrances for Solana so far is its network activity. This means that for Solana buyers to commit, on-chain activity must pick up.

Recent data indicates that Solana’s fees dropped 17% over the past week, with transaction counts down 10%. Comparatively, Ethereum layer-2s like Base and Arbitrum saw impressive growth, with BNB Chain fees also climbing 6%.

Even with $12.5 billion in total value locked, Solana’s revenue has fallen. Chain revenue is down 91% from January’s peak, which is a massive decline that has been linked to the slowdown in memecoin activity and the fading hype around the Official Trump token.

This weak on-chain performance has been making traders cautious. Without an uptick in usage, higher price levels are harder to justify.

SEC Decision on Solana ETF

Finally, Solana is suffering from a serious lack of regulatory approval. The SEC is currently facing a mid-October deadline on several Solana ETF filings.

Bloomberg analyst Eric Balchunas has now placed approval odds above 90%. If granted, a Solana ETF would open the door for institutional investors to enter. Solana’s reaction might even be similar to what Bitcoin ETFs achieved earlier in the year.

In all, from a technical perspective, the $210–$215 range remains one of the biggest barriers. Each time Solana approaches this zone, selling pressure shows up. However, the token has continued to print higher lows, which indicates that buyers are active.

If Solana breaks cleanly above $215, the path toward $250 is going to become more likely. A failed breakout, however, could push the price back toward $180.

Outlook Toward $250 and Beyond

Analysts still seem to be on Solana’s near-term future. On one hand, technical indicators show resistance holding firm around $210. On the other hand, institutional investment and the possibility of an ETF are strong sources of bullish tailwinds.

Some traders are already looking beyond $250. Fibonacci extensions and long-term support levels indicate that the $300 price level is a logical target if Solana can flip resistance into support.

For now, Solana’s price action shows an ongoing tug-of-war between retail traders being wary and institutions being confident. Whichever side wins will likely decide if SOL finally breaks free of the $200 zone and climbs toward its next milestone.

You can contact us for more informations or ads here [email protected]