TLDR

- ENA jumped 19.6% to $0.7363 with $244 million Open Interest increase signaling trader appetite

- USDe stablecoin reached $10 billion market cap in just 500 days, doubling supply in one month

- Four of five conditions met for Ethena’s “fee switch” activation, with only Binance or OKX listing needed

- Dense liquidity clusters below current price create vulnerability for potential sharp reversal

- Protocol generated over $475 million in fees with plans for Converge blockchain launch

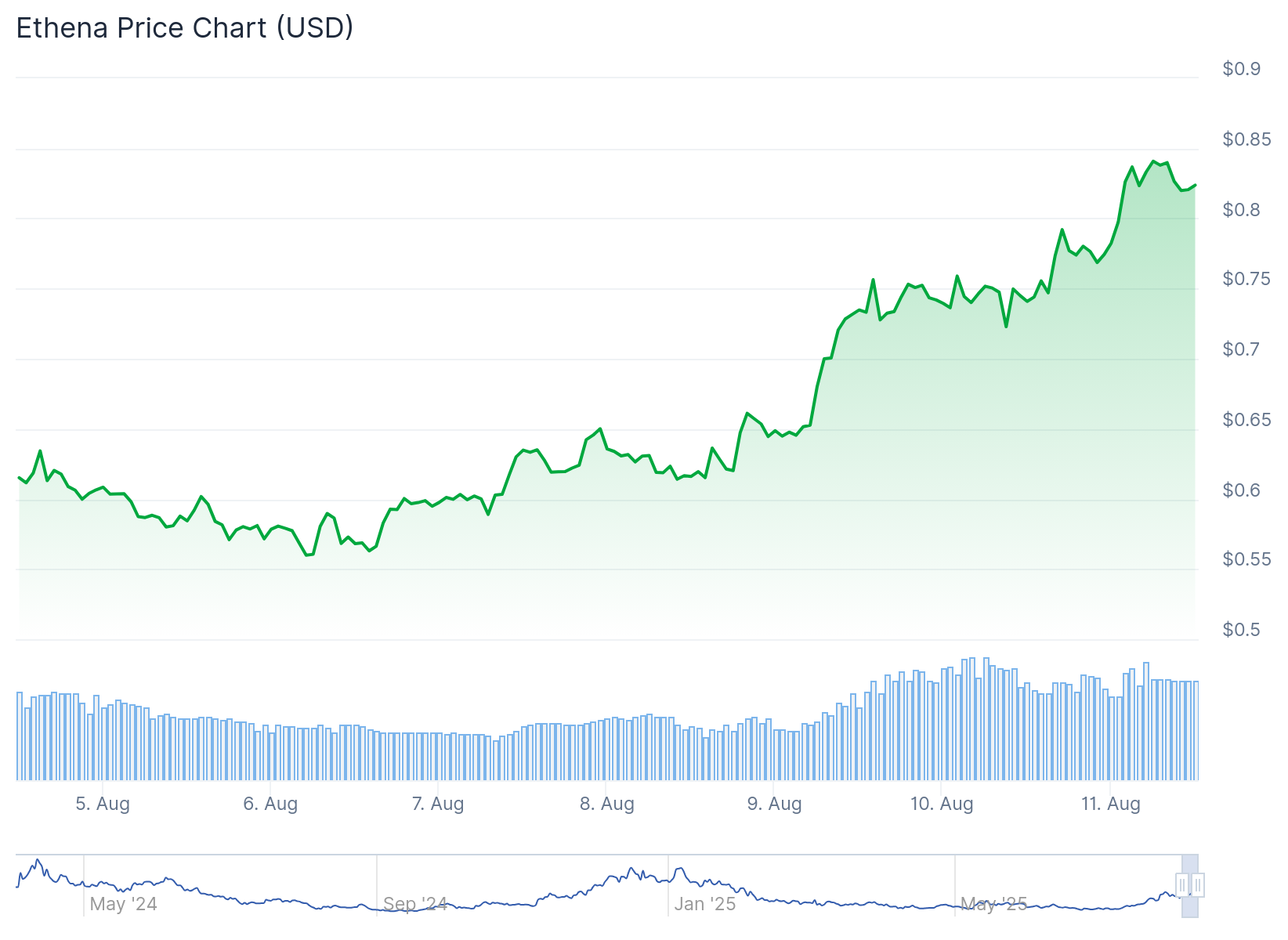

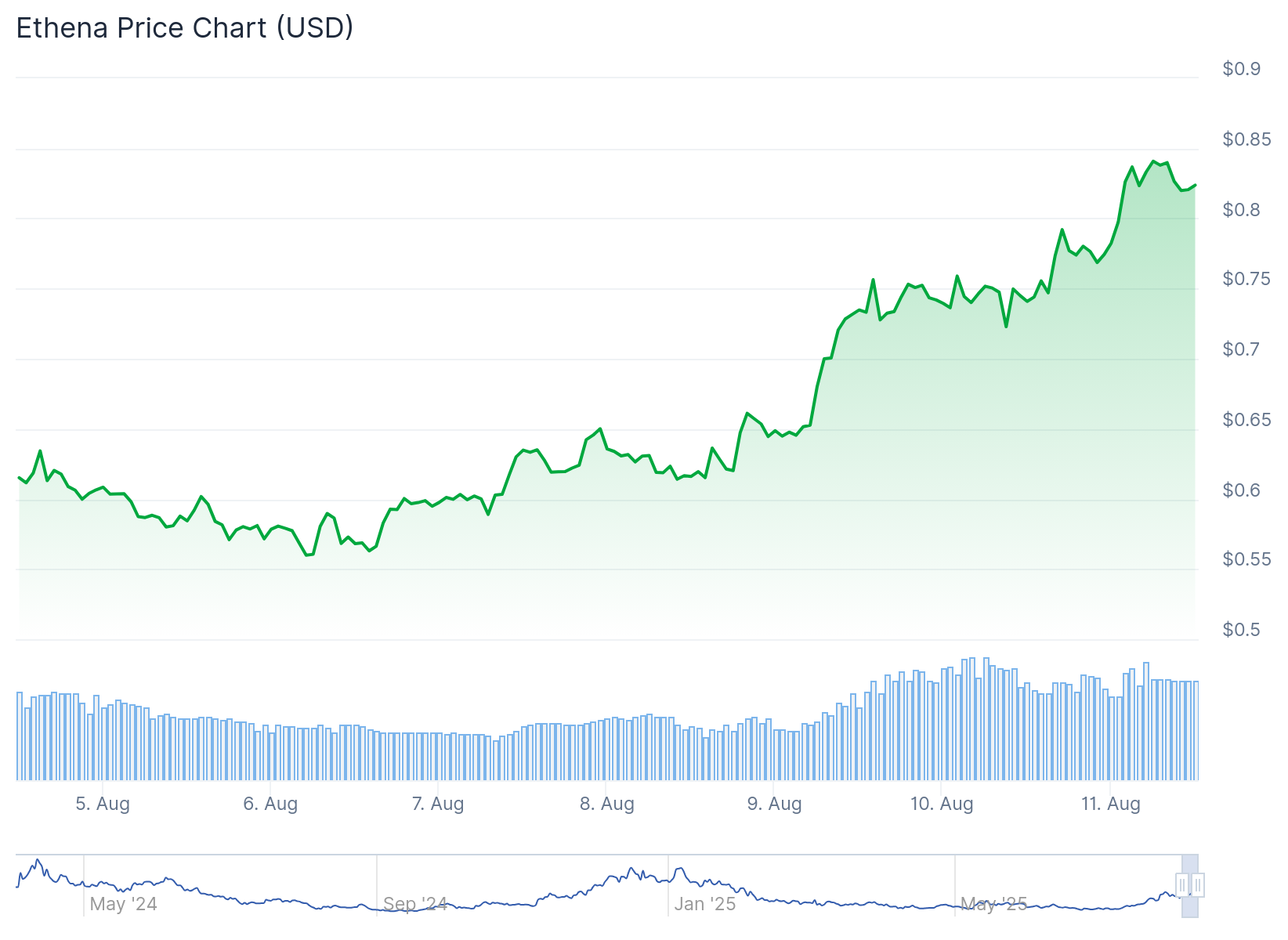

Ethena has captured market attention with a sharp price movement that pushed the token up 19.6% to $0.7363 in 24 hours. The rally made ENA the second-largest gainer according to CoinMarketCap data.

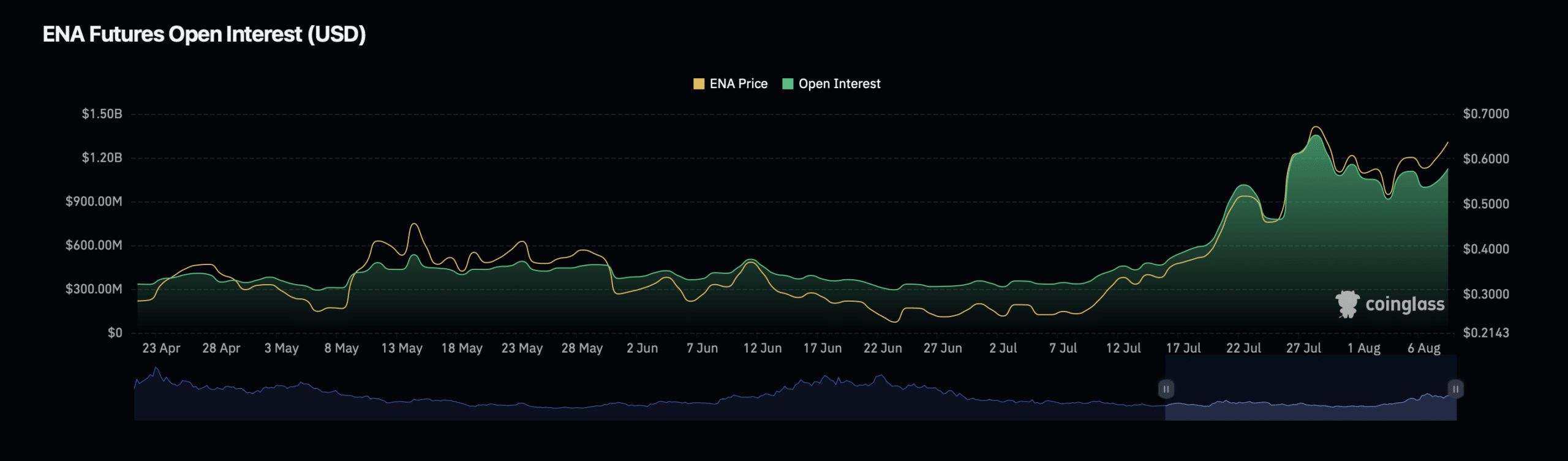

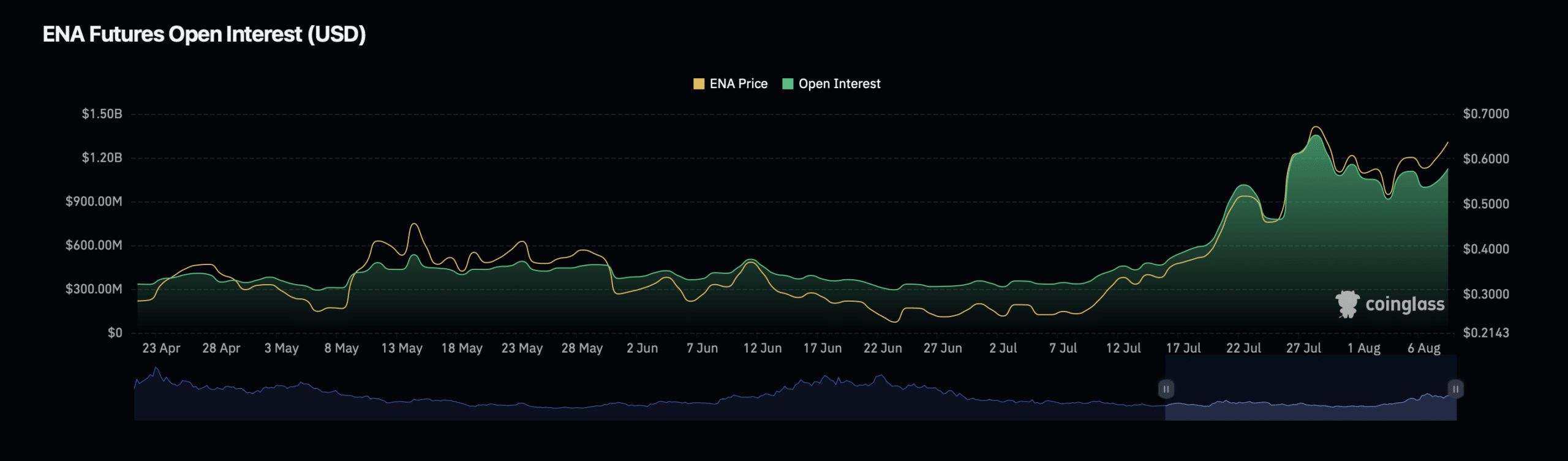

The price surge coincided with massive liquidity inflows into perpetual markets. Open Interest jumped 18% to reach $1.3 billion, representing a $244 million increase according to CoinGlass data.

The Open Interest Weighted Funding Rate turned positive at 0.0082%, indicating more bullish contracts from buyers than sellers. This metric typically signals increased trader appetite for long positions.

Spot market flows present a mixed picture for ENA. Short-term data shows $12 million in net outflows, creating bearish pressure on price movement.

However, weekly data reveals $5.7 million more inflow than outflow. This broader view suggests the market dynamic remains tilted toward buyers.

USDe Stablecoin Drives Protocol Growth

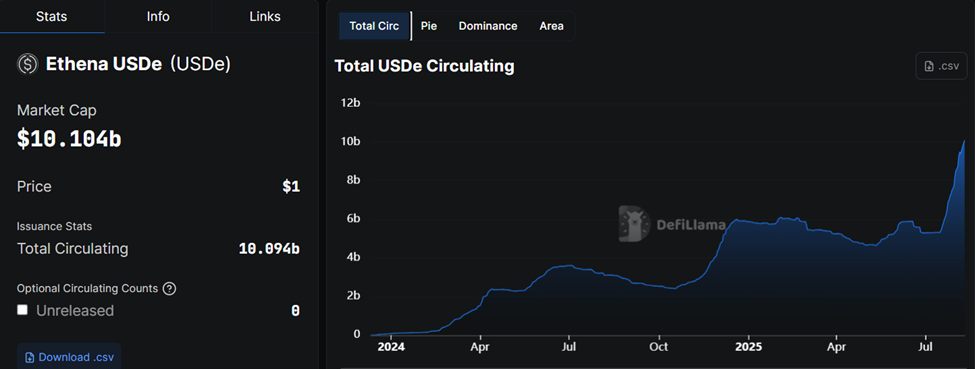

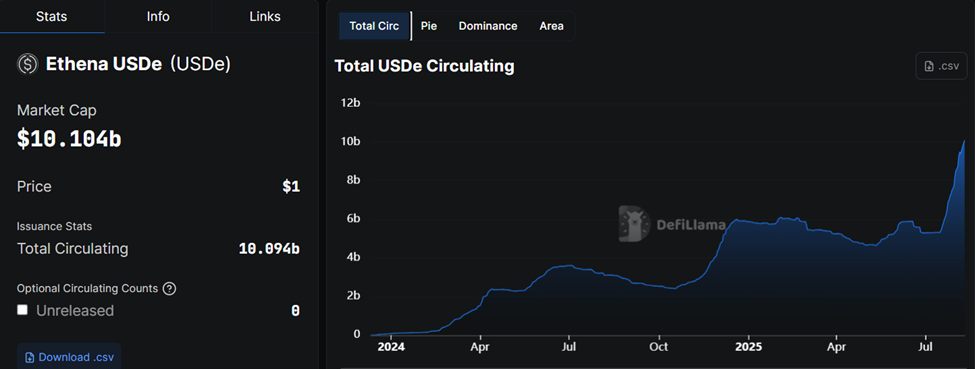

Behind ENA’s price movement lies the success of Ethena’s USDe stablecoin. The synthetic dollar reached $10 billion in market cap within 500 days of launch.

The stablecoin doubled its supply in just one month. This growth rate places USDe among the fastest-growing stablecoins in cryptocurrency history.

Ethena’s protocol has generated over $475 million in fees. The past week marked one of the highest fee-generating periods for the platform.

USDe now ranks as the third-largest stablecoin by market cap. The growth occurred following passage of the GENIUS Act.

The protocol’s governance framework outlines five conditions for activating fee distribution to ENA holders. Four conditions have already been met.

USDe supply exceeds the required $8 billion threshold. Protocol revenue surpassed $25 million and now stands above $43 million.

The Reserve Fund maintains above 1% of supply as mandated. The sUSDe APY spread sits within the required 5.0-7.5% range at around 10%.

Ethena Price Prediction

The final condition requires USDe integration on three of the top five derivatives exchanges. Currently, listings on Binance or OKX would complete this requirement.

Regulatory issues under the EU’s MiCA framework initially blocked Binance from listing USDe. The exchange’s decision to off-board EU users may clear the path for global USDe listing.

Despite bullish indicators, liquidation data reveals potential risks. The Liquidation Heatmap shows dense liquidity clusters below current price levels.

Short traders absorbed the bigger hit with $4.61 million in liquidations compared to $730,000 in long liquidations. This positioning creates vulnerability if overleveraged longs become targets.

A liquidity cascade could trigger if the market reverses direction. The concentration of liquidity below current levels leaves room for sharp price reversals.

Ethena’s long-term plans include launching the Converge blockchain with ENA as the protocol token. This development would allow ENA holders to stake tokens to validators and earn transaction fees.

The roadmap also features a planned Nasdaq listing of StablecoinX in Q4. This move could provide institutional investors direct exposure to Ethena’s ecosystem.

Critics compare Ethena’s rise to Terra’s failed UST stablecoin that collapsed in 2022. However, Ethena’s founder points to integrated risk controls and diversified DeFi collateral designed to prevent de-pegging.

ENA currently trades at $0.7759, maintaining gains of over 3% in the past 24 hours with Open Interest reaching $1.3 billion.

[email protected]