Pi Network has gained intense attention from cryptocurrency enthusiasts since 2015 when Stanford graduate developers initially introduced their concept of mobile-friendly digital assets. The prolonged development period of the project extended endlessly in the eyes of the first adopters who spent time mining Pi tokens while waiting for their upcoming reward. However, Remittix (RTX) has a better chance at reaching $10 before PI.

Pi Network’s Ongoing Transition to Mainnet

The mainnet debut of Pi Network finally enabled thousands of miners who had waited years to transfer their Pi tokens from internal wallets into exchange-based accounts enabling them to convert them into fiat currencies.

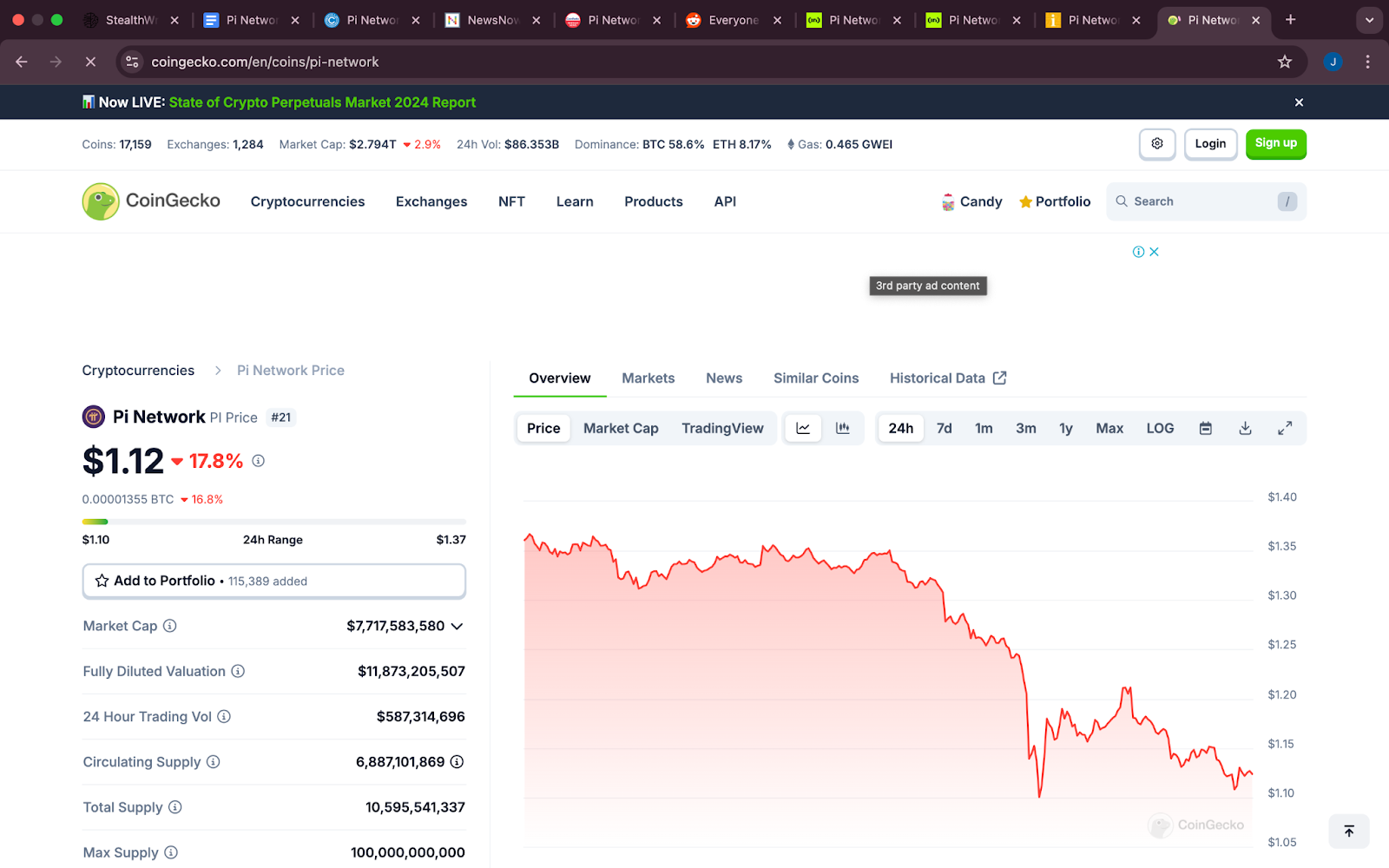

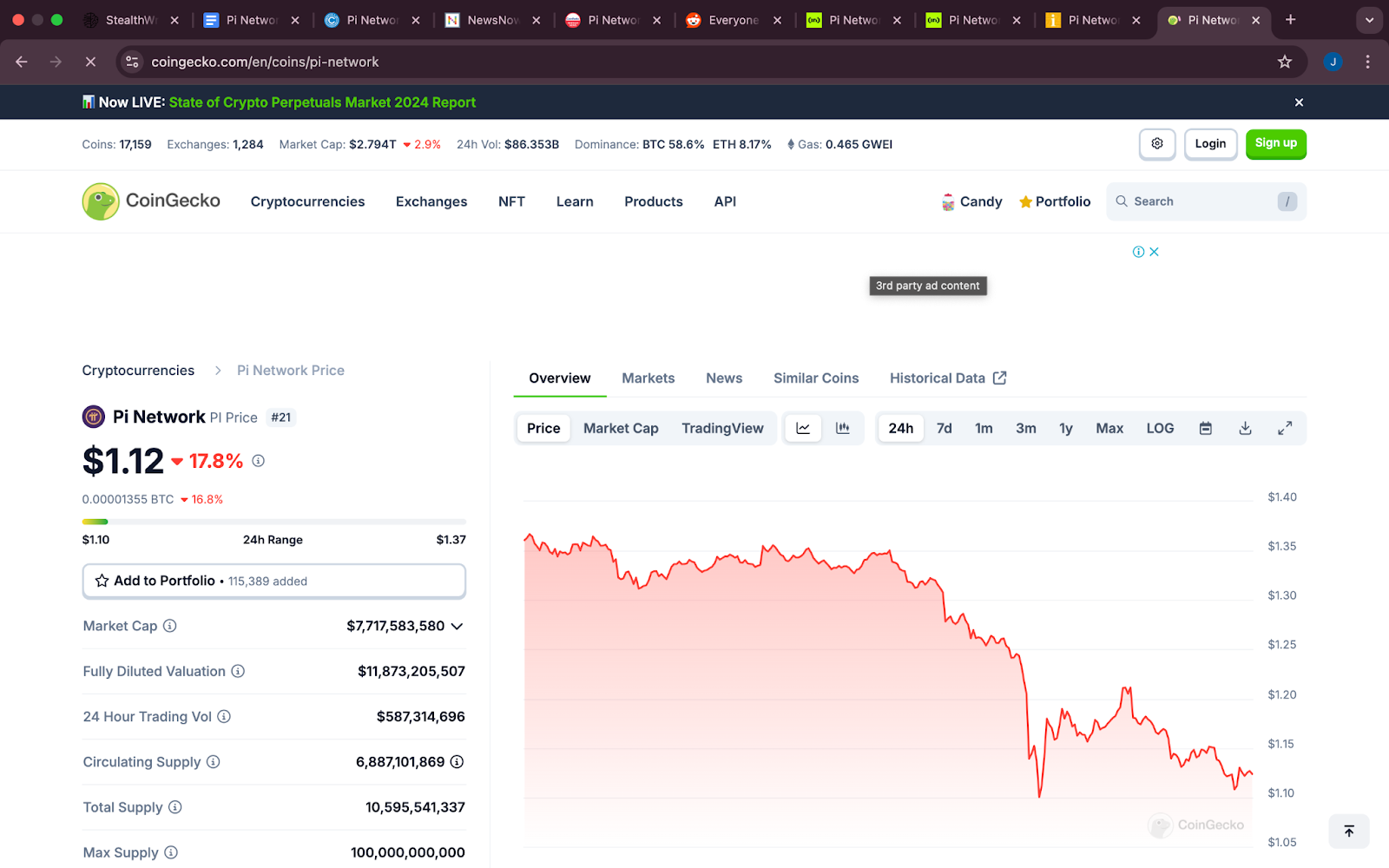

Pioneers showed no surprise regarding massive selling activities after launch because they had patiently waited multiple years to cash out. Pi token values dropped dramatically because of the conventional supply-and-demand equation that emerges when trapped tokens migrate to market circulation. The token is currently trading at $1.12.

source: coingecko.com

Trading activity continues on Pi Network because of an active user base and its presence on major centralized exchanges. The token has lost momentum in progressing toward impressive valuation because traders now focus on supply growth and decreasing returns.

The price of Pi maintains its support from numerous holders who anticipate its market value will rise when Binance conducts a new listing. Market experts remain unable to determine when Binance will list the token while the price direction of Pi Network Token exhibits bearish tendencies in its present state.

Why Pi’s Value Has Slid

After the mainnet launch announcement for Pi Network expectations were high yet multiple aspects led to a slower increase in token value than projected. Widespread excitement during Pi’s final development phase disappeared which caused investors to sell their tokens as soon as possible. The absence of Pi Network from the Binance platform reduces its chance of attracting substantial trading volumes and international market attention which major exchanges provide.

The upcoming dilution risk represents an additional challenge for Pi Network. Evidence shows through CoinMarketCap data that Pi Network will distribute a total supply of up to 100 billion tokens but only 6.8 billion tokens are active in circulation at present.

Pi Network’s technological development also created discussion regarding its .pi domain feature which the community finds interesting yet controversial. People in the community view .pi addresses as inventive since they function through Pi Browser or the “pinet.com” extension without using traditional Internet components.

Many people doubt whether domains accessible only through the Pi Browser and pinet.com extension will find practical use since they cannot be accessed through common browsers Chrome or Firefox.

A number of users have expressed concerns about who controls governance and security as well as legal oversight functions regarding .pi domains because these responsibilities rest with the permissioned Pi core team. The “Google.pi” auction caused public discussion about potential copyright violations against Google that may pose risks to Pi’s business expansion.

The attractiveness of Web3-based domain systems as an idea must gain widespread market adoption yet this future adoption needs standardized legal frameworks as well as full compatibility features.

Remittix Gains Traction at $0.0734

Remittix (RTX) has become an attractive investment option for those who desire better profitability than what Pi Network offers through its challenging operational environment. The Remittix platform achieved close to $14 million in funding while distributing more than 520 million tokens at a price of $0.0734 each.

The mission of this project centers on revolutionizing remittance industry payment methods through an efficient cross-border solution which provides relief to dissatisfied retail and institutional users of inferior banking systems.

The practical application of Remittix and its technical support system sets it apart from tokens that thrive during hype periods mainly. Development teams concentrate on practical deployment because they aim to reduce fees and improve global transaction speeds while seizing market positions from dominant providers Western Union.

Remittix stands to experience substantial price growth when it enters multiple exchanges and secures collaborations because of its identifiable practical applications related to banking.

Why Remittix Could Reach $10 Before Pi

The difference between Pi and Remittix lies in how they approach their goals since specific elements of Remittix Tokenomics create momentum for reaching $10. The tokenomics framework of Remittix ensures well-managed supply growth that enables early investors to maintain steady market position in conjunction with rising adoption numbers.

Without a significant global adoption wave or a high-profile listing in sight, Pi’s chances of reaching double-digit valuations in the near term look increasingly slim. Remittix stands to be the next big thing when it succeeds at implementing its planned features and establishes crucial relationships with financial institutions and fintech companies.

Remittix Is Your Best Bet

Pi Network achieved an important milestone by launching its mainnet while its token struggles to retain value against market forces which stem from excess supply and speculative trading alongside failed expectations of exchange listings. Remittix (RTX) stands an achievable chance of reaching $10 before Pi Network regains its previous market position since it focuses on a necessary industry transformation along with demonstrating a robust token economy.

Discover PayFi with Remittix by checking out their presale here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

[email protected]